It's been more than a month since COVID-19 made waves across the world.

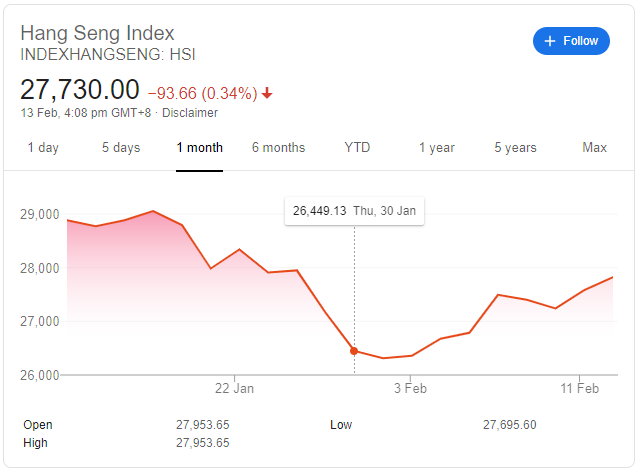

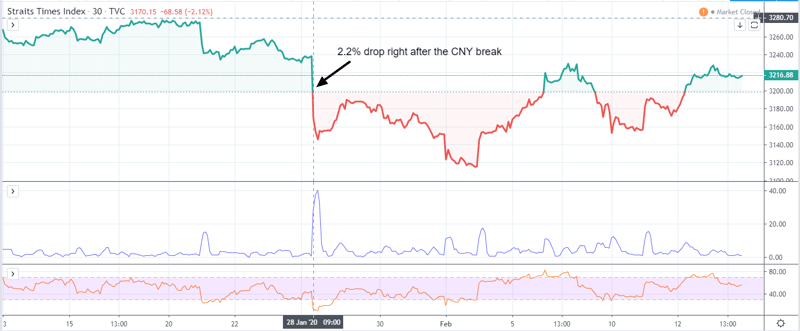

STI opened to a 2.2% loss after the CNY break while the HSI fell 5.4% when the market reopened after Hong Kong's extended CNY break.

This is the first black swan event in my investing history (that I've paid attention to) and I wanted to share some of my personal takeaways here.

Although news about the virus outbreak in China started trickling in before Chinese New Year, I did not anticipate the impacts of the virus on stock markets until the outbreak started affecting more and more countries. If I were more aware, I think I would have used my CNY break more wisely doing research into potential stocks and taken a wait-and-see approach to some of the stocks I was already planning to buy. For example, I could have delayed my purchase of MCT on 30 Jan at 2.33 and picked it up at a lower price 1-2 weeks later!

When I realized that there was a buying opportunity, my warchest was not well-prepared. and I found myself wishing I had taken more gains from the market when some of my stocks were at their 52 week high. This wish for more liquidity also made it obvious to me that I should have dealt with the laggards in my portfolio a long time ago, instead of continuing to take losses.

The two laggards in my portfolio are SingPost (S08.SI) and MM2 Asia (1B0.SI). I bought SingPost in 2017 when it was near to its all-time highs; and MM2 in 2016/7 believing its "growth story" without doing my due diligence. I thoroughly regret not cutting my losses much earlier as the share price for both are currently down 40-50% from when I bought them.

Because these laggards make up less than 1% of my portfolio, I did not give them too much thought and tried to delude myself think on the bright side that there is potential for upside in the long-term. So I kept holding on to these loss-making stocks even as their value kept dropping. This has taught me to always have an exit thesis - not just to cut losses if my investment thesis proves to be unsound, but also to know when to take gains.

Stocks bought and sold in Q1 2020

I have divested SingPost at a loss and will be divesting my stake in MM2 (also at a loss) sometime next week, as soon as my FSM One trading account is linked to CDP!

Separately, I added Ascott Residence Trust (HMN.SI) and Mapletree Commercial Trust (N2IU.SI) to my dividend portfolio (which I have discussed in an earlier post). I also deviated from my initial plan and added Alibaba (9988.HK) to my growth portfolio. In total, I invested 12k in just the first 2 months of the year! If the rest of 2020 is as eventful as the past few weeks have been, I'm going to run out of money soon 😅