Welcome to part 2 of my three-part series where I share about my retirement plan!

- Central Provident Fund (CPF): Maximize that "free" interest to build your retirement savings

- Supplementary Retirement Scheme (SRS): Short-term liquidity vs Long-term growth

- Investment Portfolio: Meet evolving needs over time

Overview: I plan to use my CPF monies as the most basic level of retirement funds (via CPF Life) from age 65 onwards. The monthly payouts will then be supplemented by withdrawals from my SRS account and dividend payouts (and drawdown on investment capital if necessary) from my investment portfolio.

Supplementary Retirement Scheme (SRS): Short-term liquidity vs Long-term growth

Following in the footsteps of Kyith from investmentmoats.com (here's the link to his post), I opened my SRS account last year with $1! This effectively "freezes" my starting withdrawal age at 62, the current statutory retirement age. I don't expect this retirement age to go up significantly in the next 5 years but since I won't be turning 60 till at least 3 decades later, I decided to be kiasu and lock this in first.

How does the SRS account factor into my retirement plans?

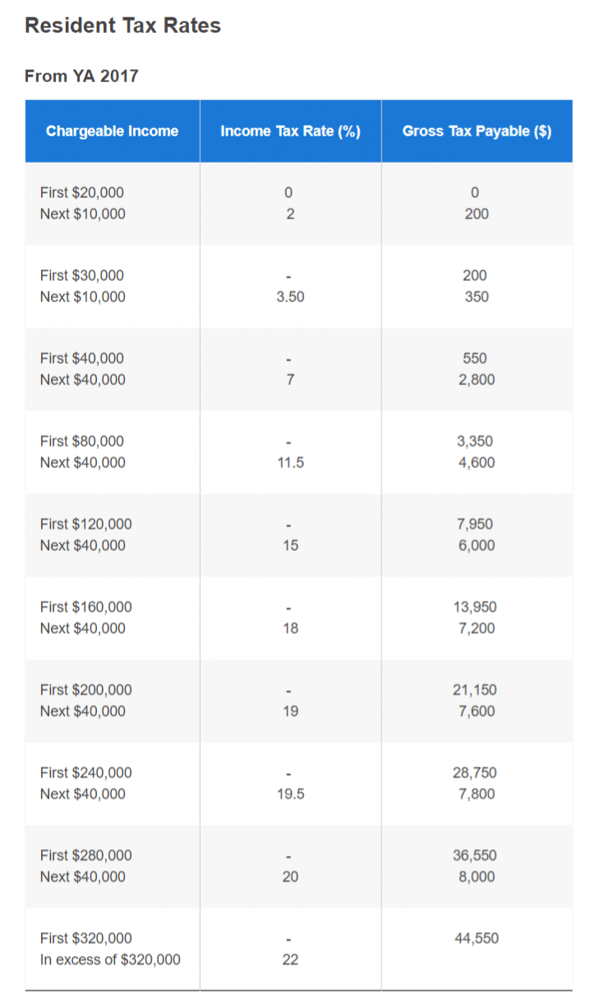

In my opinion, contributing to your SRS account makes the most sense only when your annual taxable income enters the 11.5% tax bracket.

Contributions to the SRS are tax-deductible which makes it a great way to reduce the amount of taxable income you have for the year, especially if it will help you avoid paying 11.5% of your income as tax. The trade-off is a reduction in liquidity as your money will be locked up in the SRS account until the statutory retirement age when you can withdraw your funds over 10 years.

Let's illustrate this with an example:

小明 earns an annual income where $95,300 is considered taxable. With reference to the table of tax rates below, his income tax is calculated as $3,350 + ($15,300 x 11.5%) = $5,109.50 if he does not make any SRS contributions.

Scenario 1

If 小明 makes a $15,300 contribution to his SRS account, his taxable income becomes $80,000 which is within the maximum limit of the 7% income tax bracket. Therefore the income tax he needs to pay for the year is $3,350. Not only does 小明 get to keep his $1.759.50 (11.5% of $15,300) every year, his SRS account will grow significantly from these annual contributions of $15,300.

The best part? All that money remains his and by investing in blue chip stocks, unit trusts, endowment and mutual funds or even robo-advisors like MoneyOwl, he can grow it over time beyond the total sum of his contributions.

The main trade-off here is that your effective liquidity is reduced by $15,300 in the short-term.

On the flip-side, one can say that $1,759.50 is not that much. What if 小明 decides to pay the income tax anyway and keep his assets liquid?

Scenario 2

If 小明 does not make any contributions to his SRS account, the additional liquidity he has is $15,300 - $1,759 = $13,540 (rounded)

He would have to invest this money with 12.99% returns p.a. just to earn back the money that was paid as income tax. It is generally quite difficult to consistently grow your money at this rate year on year unless the economy is on a bull run. Alternatively, 小明could invest outside of Singapore but that would mean taking on higher risk as overseas markets are rarely as stable as Singapore.

As long as I don't need that liquidity in the short-term, I would much rather keep my money in the SRS account where I can grow it over time. What I really like about the SRS is the "closed loop" ecosystem it has. If monies in the SRS account are invested in dividend paying instruments, these dividend payments get credited back into the account where they can be reinvested to compound over time!

Withdrawing from the SRS account

At the end of the day, it all comes down to liquidity. Any withdrawals from the SRS account before retirement age are 100% taxable with an additional 5% penalty.

So it is really crucial that what you plan to deposit into your SRS account is not money you need before you reach the retirement age.

When you reach the retirement age that is applicable to you/your account, any withdrawals from your SRS account are 50% taxable. The taxation rate follows the income tax brackets. So the maximum income you can withdraw each year with $0 income tax payable is $40,000. Do note that if you're still employed when you withdraw from your SRS account, even after retirement age, your combined income will be taxed. So if you're earning $10,000 at your day job and withdraw $40,000 from your SRS account, the taxable income is $40,000/2 + $10,000 = $200.

Another thing to note is the fixed, 10 year withdrawal period. From the date of your first withdrawal from your SRS account, you have to complete all withdrawals within the next 10 years. Do check out the IRAS page on SRS withdrawals as it has detailed calculations for various scenarios. Taking into account that $40k is the maximum withdrawal amount to avoid taxation, I aim to maintain the funds in my SRS account up to maximum of $400,000 (including investment gains) to avoid a situation where I have to withdraw >$40k and pay income tax on the excess. Unless the government decides to revise the initial income bracket upwards...

Part 3 of my retirement plan is here! If you missed out on Part 1, read it here!

Image credits